Is crypto dead?

As the fear of increasing inflation continues to rattle the financial markets it would seem that all eyes are now looking towards crypto currencies. Crypto was the the darling of the pandemic boom. People sitting at home with time and money on their hands started to invest where they thought they could get a good return. And with crypto currencies increasing in value seemingly everyday, a lot of money was invested. This increasing demand drove up the price further and it became self fulfilling.

The draw of increasingly high returns became so strong that even large financial institutions thought they had to get in on the act. A number of them started to offer exposure to crypto, even though they are unregulated products, thus giving crypto the allure of respectability and the perceived rubber stamp of approval.

But with Bitcoin having plunged below $20k last weekend and with billions wiped off crypto values worldwide it looks like a day of reckoning is coming. Unfortunately these patterns have a habit of repeating themselves. Think tech stocks in the dot com boom, mortgage derivatives in the 2008 crash or tulip bulbs in the original speculative market (way back in 1634, yep human behavior hasn't changed a lot!).

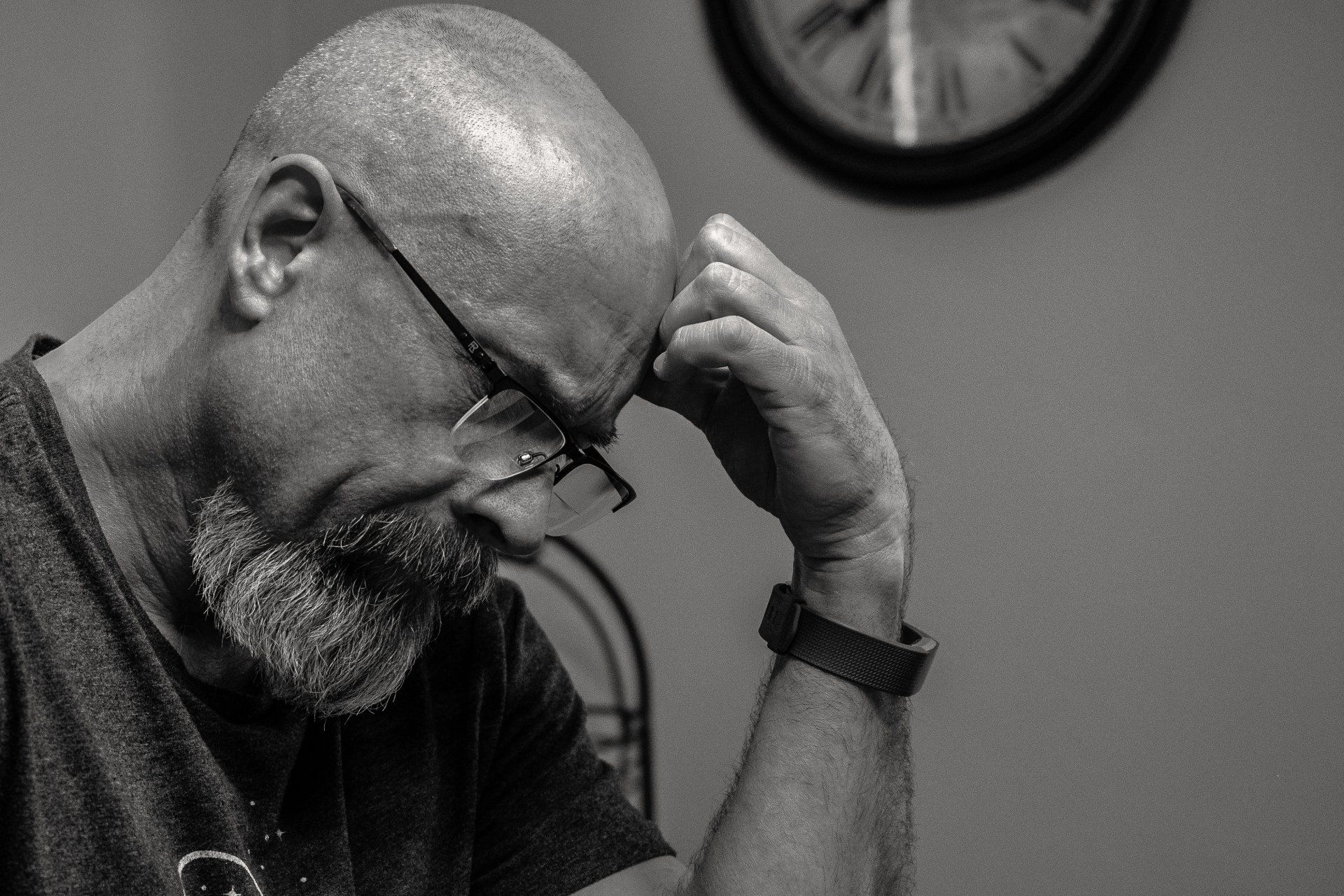

When something looks too good to be true it more often that not is. But your brain is working on a basic feedback cycle and when it sees that your investment keeps increasing, the logic tells it that if you put more in you will get more back! Hey, even the great Sir Isaac Newton couldn't resist. We find the story in Benjamin Graham’s 1949 classic The Intelligent Investor, he writes:

Back in the spring of 1720, Sir Isaac Newton owned shares in the South Sea Company, the hottest stock in England. Sensing that the market was getting out of hand, the great physicist muttered that he ‘could calculate the motions of the heavenly bodies, but not the madness of the people.’ Newton dumped his South Sea shares, pocketing a 100% profit totaling £7,000. But just months later, swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price — and lost £20,000 (or more than $3 million in [2002-2003’s] money. For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.

So is crypto and more specifically Bitcoin dead? Well it's only dead if everybody sells and it no longer exists. We are told that 70% of investors in Bitcoin have lost money which means that 30% haven't. If you've lost money you may want to get out before losing more or you may hold on because 'it's got to come back at some point hasn't it?'. Equally if you have made money you presumably haven't already sold for a reason, either you bought it at a low enough price that you have more margin to play with or you also think it's going to stabilise and recover. The other dynamic at play here is that a lot crypto is held in very small quantities, particularly by Gen Z investors. So they may have invested £200 and now it's worth $50, is it really worth cashing that in?

The markets typically cycle through 10 years boom and 10 years bust, so financial market bubbles occur with unfortunate regulatory, we've just had a very good run this time! It's almost like each generation has their own crisis which brings home to them the fundamentals of investing (once bitten, twice shy).

For most people the thought of financial investing at the moment makes no sense. Stocks have dropped significantly and look set to drop further so why would you put any money in now? But the bottom line is you still need to make a return on your hard earned savings and investments so what do you do?

Well in our opinion you move away from thinking about long term investment to thinking about short term returns. You learn to trade.

That means you don't think about what's happening to prices in the coming weeks and months you literally just look at price changes over the course of the day. Futures and commodity prices go up and down all day giving lots of opportunities for profit via either long or short trades. And with micro e-mini contracts on the Nasdaq (NQ) starting at just $2 it is a low risk way to learn to trade.

If you want to learn to trade or want to improve your trading choose an award winning system like Inteligex supported by comprehensive training and loved by it's Members.

Set up your Personal Consultation to learn how you could be making $200 - $300 per day.

All comments are personal opinions only and not intended as investment or trading advice. Inteligex accepts no liability or responsibility whatsoever for any loss or damage resulting from the use of Inteligex products, services or opinions incurred while trading or investing.